Our Take on the 2023 M+R Benchmarks Report

Every year, fundraisers throughout the industry wait for the release of the M+R Benchmarks. This report provides one of the few public facing benchmarks for digital fundraising, giving our clients valuable insights into how their digital programs are performing.

This is a vast undertaking, for which we are thankful to M+R for putting together. But it can be a lot to sift through, so we did it for you!

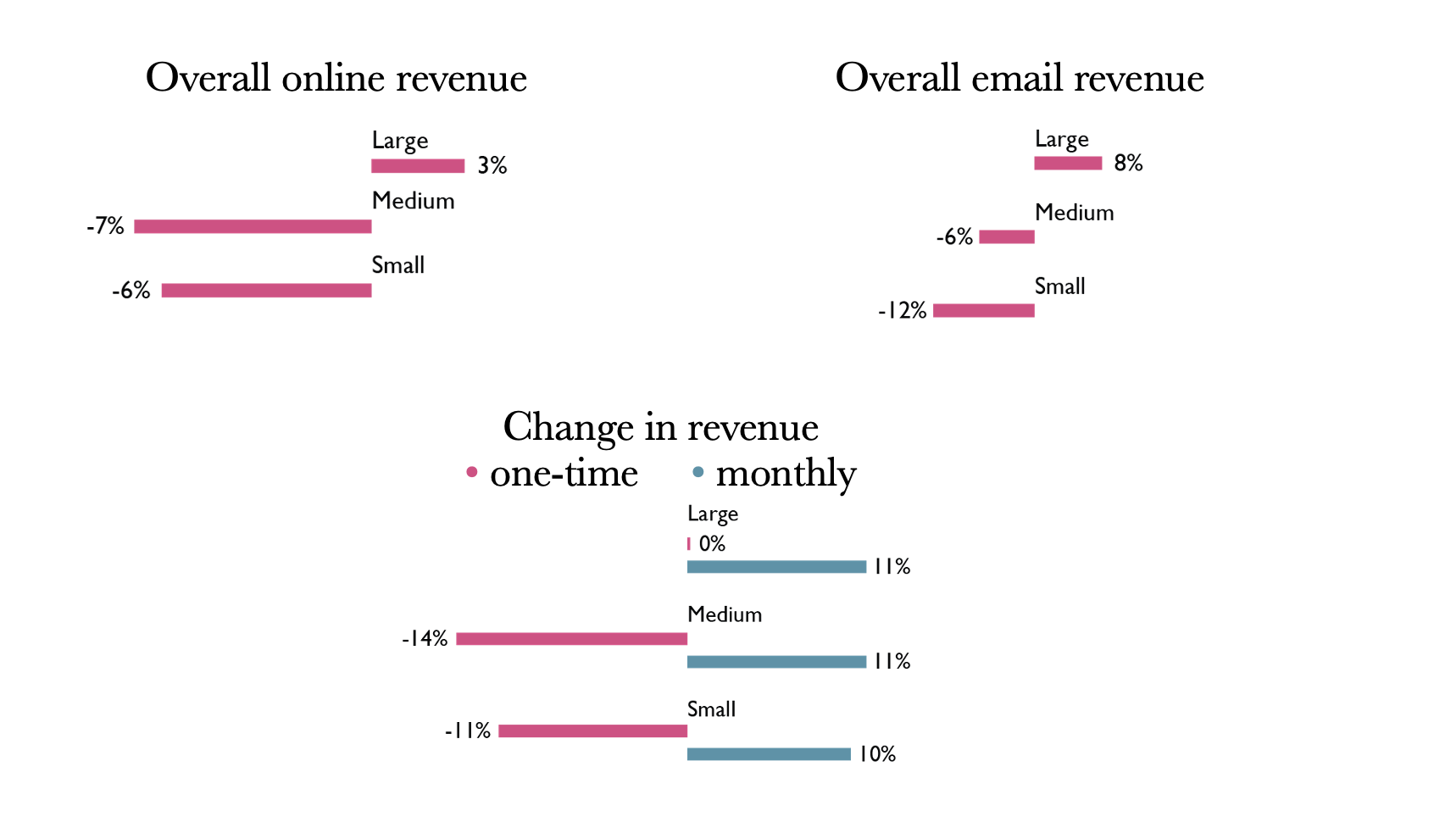

The big takeaway is that online revenue was down by 4% in 2022 compared to 2021.

While there are many factors at play, a big one is that we are coming down from a multi-year high during the pandemic years (this is especially true for many Hunger and Poverty organizations).

What many of the organizations who had a decline in revenue are dealing with is a retention issue and not a recruitment issue. They’ve grown the file, now they are dealing with the hard work of retaining donors. This is not easy, especially with disasters, political issues, questions around the economy and more capturing much of the energy in the world.

But with Retention Rates at a 5-year low, this is a key area Lautman encourages organizations to devote resources towards to ensure all of the gains from the past few years aren’t lost.

Giving Tuesday and December 31 this year will be key turning points to see if we can engineer a retention turnaround. Those two single days account for 8% of all online revenue for the year. If we can reverse the revenue declines we saw in 2022 (each date was down 13% compared to 2021), that will go a long way towards many nonprofits having a successful year.

And there is hope that this can be done, especially because the template already exists.

Large Nonprofits (those raising over $3 million annually) actually increased online revenue by 3% in 2022. How did they do this?

They were more efficient in raising money from email and, yet, were not as reliant on email as a fundraising channel. In 2022, large nonprofits brought in $117 for every 1,000 emails sent, 18% more than Small Nonprofits and 63% more than medium nonprofits. Combined with only 11% of all online revenue coming from Email for Large Nonprofits (compared to 17% for Small and 16% for Medium), you can see that using more digital channels is a key part of the recipe for success.

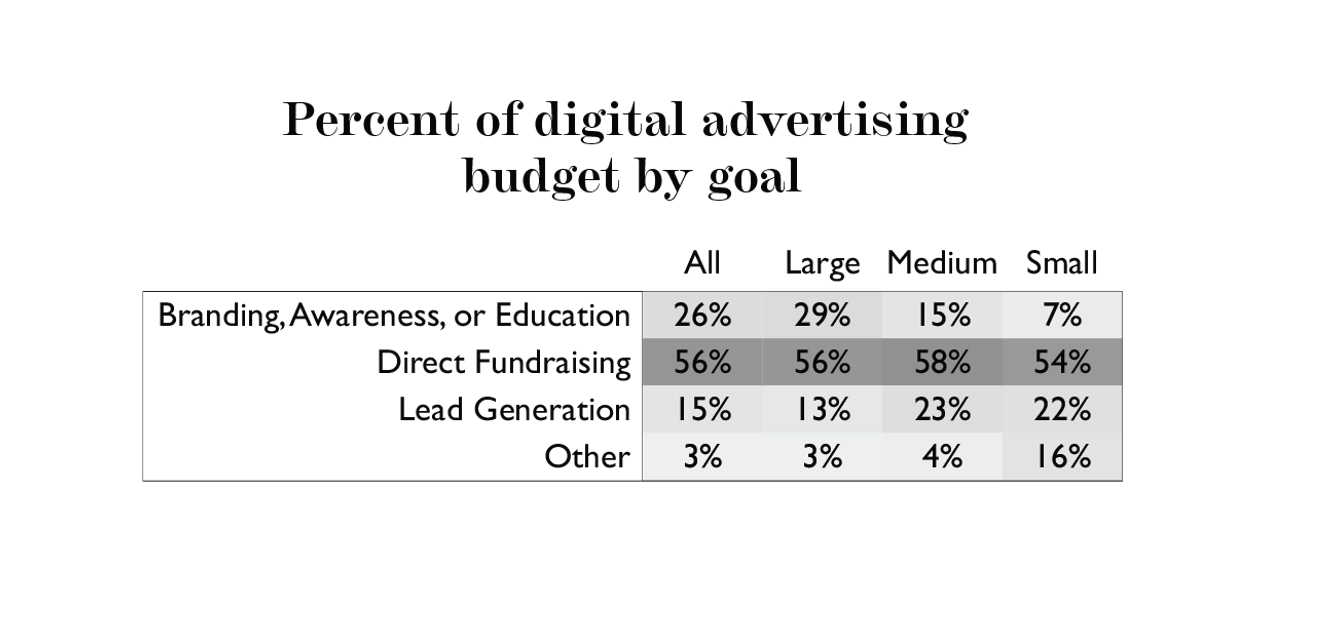

Large Nonprofits also spent more on advertising. Now, because they bring in more revenue, they can afford to invest a larger raw amount back into their program. That is important, but just as important is what they invested in.

Compared to smaller nonprofits, large nonprofits invested more in branding, awareness, or education ads than in lead generation ads. They made the active decision to invest more in brand awareness than in bringing on new email addresses. And they made this bet because they assumed spending the time to educate potential leads about who they were first and turning them into warm prospects, would lead to more engaged and active person once they converted from prospect into lead and/or donor.

And they were right!

As a whole, the industry saw decreases in return on ad spend (ROAS) in 2022. Display was down 44%, Search was down 26%, and Meta was down 12%. However, large nonprofits actually saw an increase in many of those categories! The investment in their top of funnel allowed them to reap benefits later on.

So what can you do?

- Remember that it’s not all about email — you need to spend resources optimizing performance on other channels. Don’t forget your website donation form, lightboxes, SMS and peer to peer tools!

- Make sure to balance one-time and monthly giving. You need both to have a strong program and continue to see revenue grow each year.

- Invest in brand awareness, and practice patience as you wait for the revenue to show up in other places.

- Start planning your year-end strategies NOW – there is a lot of revenue on the line!

See the full M+R Benchmark report.